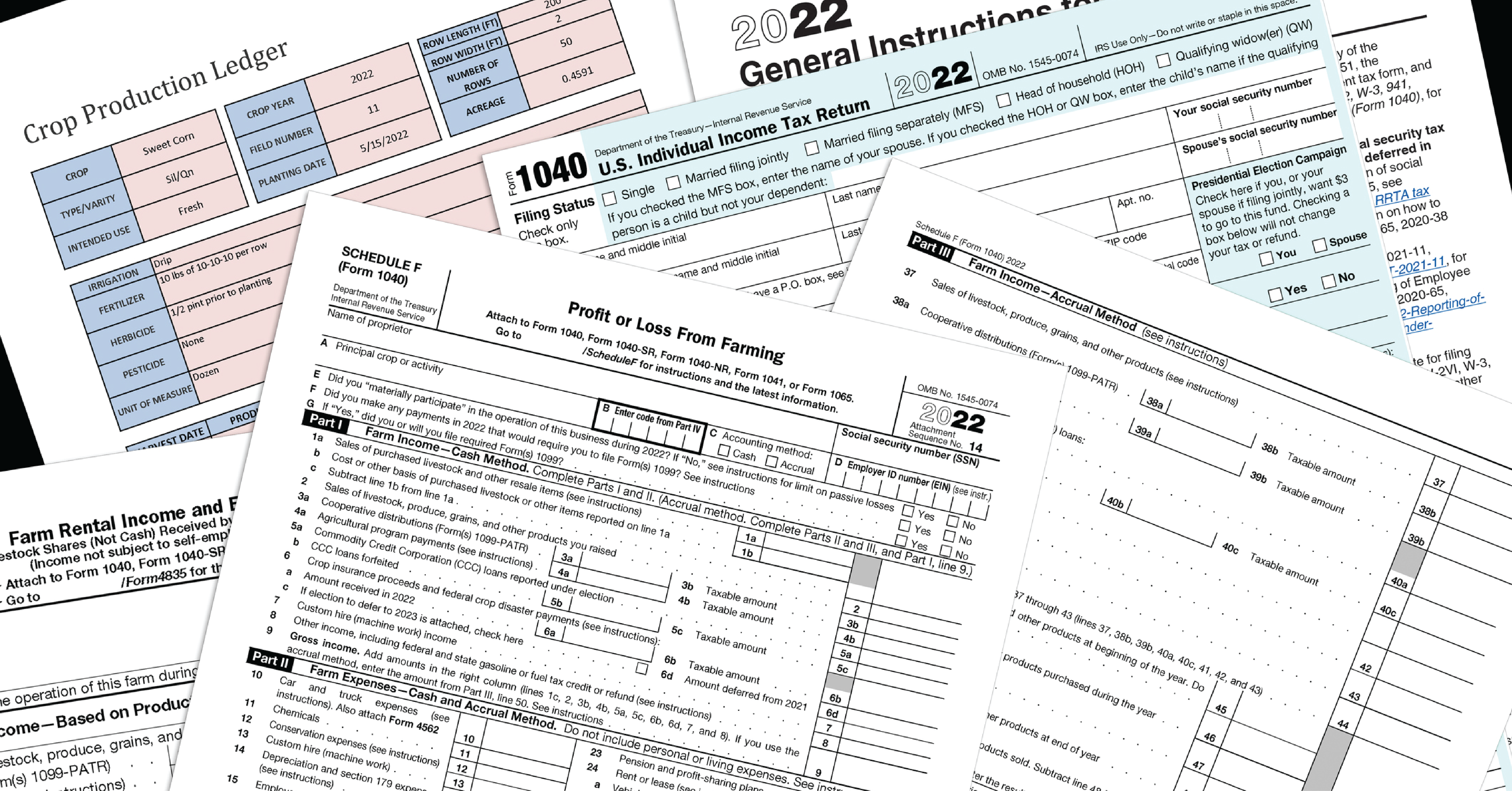

Retirement Income Series – What About Taxes?

August 22, 2023“Anyone may so arrange his affairs that his taxes shall be as low as possible, he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one’s taxes.” – Judge Learned Hand – Helvering v. Gregory, 69 F .2d 809, 810-11 (2d Cir.1934)

Believe it or not, that’s not an inspirational financial quote, but, in fact, a current U.S. law. What this means is that while taxes are unavoidable, you also don’t have to pay more than is legally expected. Never is this more true than when you’re moving into retirement.

We can’t outrun it, but that doesn’t mean we can’t plan for it! Taxes can eat into your retirement income quickly and leave you with less than you thought you’d have to live off. A big part of protecting your income and lifestyle from being depleted by taxes is diversifying your income streams with taxable, tax-deferred, and tax-free strategies.

The majority of pre-retirees will have some level of taxable account (checking, savings, brokerage accounts), then tax-deferred accounts (401k, IRA, etc), and tax-free accounts (Roth IRA, Roth 401k). There is generally an ideal amount for each “bucket” to reduce the overall tax impact on your retirement. When you can strategically plan out your taxes in retirement, you can make sure you keep as much as you can of your hard-earned money, while still ensuring you pay any taxes due.

With proper planning and guidance from a retirement professional, these methods could help protect too much of your retirement income from Uncle Sam and help keep your golden years golden! If you would like to discuss in further detail any questions or concerns about taxes in retirement and how they could affect you, please don’t hesitate to contact our office at 336.450.2161 to set up your complimentary retirement tax analysis. We look forward to helping you!

Corey R. Hodges

Investment advisory services offered through the Impact Partnership Wealth, LLC (“IPW”), a Registered Investment Advisor firm. Registration is not an endorsement of the firm by securities regulators and does not mean the advisor has achieved a specific level of skill or ability. This email is being sent by, or on behalf of, a Registered Investment Advisor. It is intended exclusively for the individual or entity to which it is addressed. This communication may contain information that is proprietary, privileged, or confidential, or otherwise legally exempt from disclosure. If you are not the named addressee, you are not authorized to read, print, retain, copy, or disseminate the email or any part of it. If you have received this email in error, please notify the sender immediately by email or fax, and destroy all copies of this communication. Please be advised that you may conduct securities transactions only by speaking directly with your Investment Advisor Representative, either by phone or in person. Requests for securities transactions via email will not be executed by Impact Partnership Wealth, LLC. To help protect your privacy, we strongly suggest you avoid sending sensitive information, such as account numbers and social security numbers via email. Please be further advised that, pursuant to the Bank Secrecy Act, the USA Patriot Act, and similar laws, any communication in this email is subject to regulatory, supervisory, and law enforcement review. Insurance and annuities offered through Fortified Futures, Inc, NC License #18786413.